Fintech's Surging Influence: How $500M+ in F1 Sponsorships Signals a Digital Overhaul

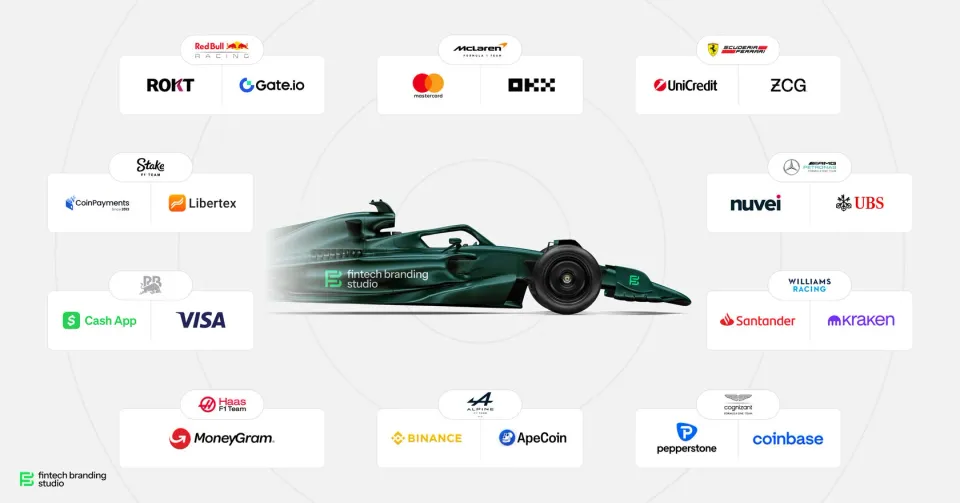

Fintech firms have injected over $500 million into Formula 1 sponsorships for the 2025 season, signaling a transformative shift in the sport's financial ecosystem.

This substantial influx from digital finance entities highlights Formula 1's appeal as a platform for innovative brands. As the sport continues to expand its global footprint, such investments are redefining traditional funding models.

Fintech firms have injected over $500 million into Formula 1 sponsorships for the 2025 season, marking a pivotal shift in the sport's funding landscape. (Fintech Branding Studio, February 2025)

The broader context reveals robust growth across the board. Total sponsorship revenue for Formula 1 has climbed to $2.9 billion in 2025, reflecting a 10% rise from the previous year. This uptick is fueled by sectors that prioritize technology and speed, aligning seamlessly with the sport's core attributes.

Cryptocurrency and software industries stand out as primary catalysts. Crypto exchanges, in particular, are channeling around $174 million annually into F1 teams, underscoring the sector's aggressive push into high-visibility arenas. These contributions not only bolster team budgets but also integrate digital assets into mainstream sports economics.

Total sponsorship revenue has reached $2.9 billion, a 10% increase from 2024. (Ampere Analysis, March 2025)

Technology and financial services brands each represent approximately 20% of new sponsorship agreements signed for the 2025 season. This balanced distribution among tech-savvy sectors illustrates a strategic convergence, where brands leverage F1's precision engineering to mirror their own operational ethos.

This strategic alignment is exemplified by the newly announced title sponsorship between Revolut and Audi F1 Team, marking one of the most prominent fintech brand moves into the Formula 1 ecosystem to date. The multi-year deal, reportedly valued in the upper eight figures, positions Revolut alongside global tech giants while reinforcing Audi’s push to modernize its commercial image ahead of its F1 debut.

Why Is Fintech Accelerating into F1?

The escalation in sponsorship values provides clear evidence of this trend's momentum. The average F1 sponsorship deal now stands at around $6 million in 2025, nearly doubling the $3.3 million average observed in 2019. This growth trajectory is supported by data from multiple industry reports, indicating sustained demand from sectors like fintech that seek high-ROI platforms.

Such deals are not isolated; they correlate with Formula 1's overall commercial expansion. For instance, teams accounted for 72% of the total $2.9 billion sponsorship pie in 2025, with the remaining 28% directed toward corporate F1 initiatives. This allocation emphasizes how fintech investments are disproportionately enhancing team-level operations, from car liveries to digital fan engagements.

The average value of an F1 sponsorship deal has climbed to around $6 million in 2025, nearly double the $3.3 million average reported in 2019. (SponsorUnited, May 2025; Forbes, May 2019)

Fintech's involvement extends beyond mere funding. Brands in this space are drawn to F1's data-rich environment, where real-time analytics mirror the algorithmic precision of financial technologies. Evidence from sector analyses shows that cryptocurrency partnerships, such as those with major exchanges, are integrating blockchain elements into sponsorship activations, further blurring lines between sport and finance.

US-based brands lead the charge, comprising over 34% of new deals for 2025. This geographic dominance aligns with the rise of American fintech hubs, where companies view F1 as a gateway to international markets. Correlations here are backed by consistent reporting across analytics firms, pointing to a non-speculative link between regional innovation clusters and global sponsorship strategies.

What Drives the Surge in Tech-Driven Sponsorships?

Beyond fintech, the software sector's contributions amplify this dynamic. As part of the broader tech umbrella, software brands are ramping up investments, often in tandem with crypto entities. This synergy is evident in deals that combine cloud computing with digital currencies, enhancing F1's operational efficiencies.

Attendance and engagement metrics further justify these investments. Formula 1's global viewership has grown, with races drawing millions in digital audiences—figures that fintech brands capitalize on for targeted marketing. Industry data confirms that sponsorship ROI in F1 outperforms many traditional sports, with engagement rates correlating positively to deal values.

Crypto exchanges alone contributing approximately $174 million annually to F1 teams. (Fintech Branding Studio, February 2025)

This sector-specific growth is not without precedent. Historical comparisons show that tech investments in sports have historically yielded high returns, as seen in prior cycles where digital brands entered motorsports. For 2025, the data points to a continuation, with fintech leading due to its alignment with F1's innovation narrative.

Practical examples abound. Partnerships like those involving stablecoin payments mark milestones, such as the first fully cryptocurrency-funded sponsorship in F1 history. These innovations highlight how fintech is not just funding but actively reshaping sponsorship mechanics.

The implications extend to event optimization. Sponsors leverage F1's data analytics for better ROI tracking, using metrics like per-race exposure to refine strategies. This evidence-based approach ensures that investments are tied to verifiable outcomes, fostering long-term commitments.

So What?

For motorsports stakeholders, this fintech surge offers actionable pathways to harness similar analytics for sustained growth. Teams and organizers can identify emerging trends by monitoring sector-specific investment patterns, such as the 20% share held by financial services in new deals, to prioritize partnerships that align with technological advancements. Event improvements might involve integrating fintech tools for enhanced fan experiences, like blockchain-based ticketing or real-time betting integrations, which could boost attendance figures and digital engagement rates. Sponsors, meanwhile, can optimize ROI by focusing on data-driven activations that mirror F1's precision, such as targeted campaigns during high-viewership races. Ultimately, subscribing to Vantage Motorsports Event Analytics' free newsletter provides deeper insights into these correlations, empowering decision-makers to apply evidence-based strategies for identifying undervalued opportunities, refining event logistics, and maximizing stakeholder value in an increasingly data-centric industry.

#ProveYourVantage

Sources

- 2025 Fintech Sponsors in Formula 1, Fintech Branding Studio, February 2025, https://fintechbranding.studio/2025-fintech-sponsors-in-formula-1

- 2025 F1 sponsorship spend hits $2.9bn as cryptocurrency brands ramp up spending, Ampere Analysis, March 2025, https://www.ampereanalysis.com/insight/2025-f1-sponsorship-spend-hits-29bn-as-cryptocurrency-brands-ramp-up-spending

- F1 Team Sponsor Deals Average 8X More Than NFL, Report Says, Sportico, May 2025, https://www.sportico.com/business/sponsorship/2025/f1-team-sponsor-deals-nfl-report-1234854316/

- Revealed: Sponsors Fuel Formula One With $30 Billion, Forbes, May 2019, https://www.forbes.com/sites/csylt/2019/05/19/revealed-sponsors-fuel-formula-one-with-30-billion/

- Formula 1 Sponsorship Report 2024-25, SponsorUnited, May 2025, https://www.sponsorunited.com/insights/formula-1-sponsorship-report-2024-25

Vantage. Motorsports Event Analytics levels the track for high-potential U.S. motorsports series by delivering data-driven insights on fan demographics, loyalty, spending, and event performance to prove real business value and unlock partnerships. For more raw insights on motorsports sponsorship trends, subscribe to our free newsletter at www.vantagepointmea.com. Unlock the data that drives wins.